- QUICKBOOKS DESKTOP PAYROLL SALARIED UNPAID TIME HOW TO

- QUICKBOOKS DESKTOP PAYROLL SALARIED UNPAID TIME MANUAL

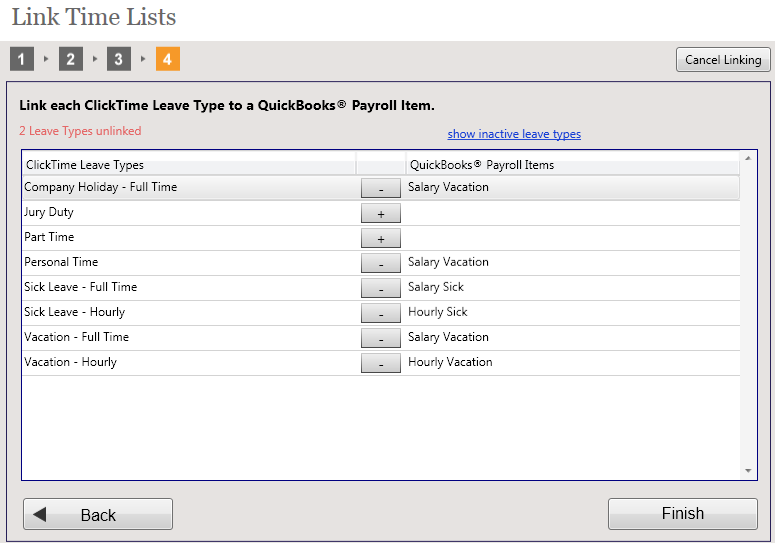

This report shows the payroll earnings, deductions, and tax items as well as the current tax table limits and rates. Select Reports > Lists > Payroll Item Listing report. Errors in the set up of the payroll item mapping can be located through a Payroll Items Listing report. Payroll items must be assigned an account so payroll transactions can be properly recorded in the general ledger. Importance of Payroll Item Account Mapping The result will be offsetting amounts to the liabilities accounts which will clear the Pay Scheduled Liabilities window, but not affect the general ledger accounts.Īdditional Areas to Troubleshoot Payroll Errors Include the check number actually used to pay the liabilities in the memo section as a reference.Ħ. Add additional lines in the expenses area for the same accounts already listed with a negative amount to offset the entry.ĥ. In the Liability Payment – Checking window, change the check amount to zero.Ĥ. Select the appropriate item from the Pay Scheduled Liabilities window as shown below and click the View/Pay button.ģ. First, verify that the liabilities have been paid.Ģ. If the liabilities were recorded through any other method, such as a check being written and coded to the Payroll Liabilities account, the liabilities shown as due will not be reduced.ġ. The liabilities amounts appear in the section when a payroll is generated and are only reduced when the Pay Scheduled Liabilities method is used to pay the taxes due. The Pay Scheduled Liabilities section in the Payroll Center may have red overdue amounts showing when none exist. Getting the Red Out – Clearing Out Past Due Liabilities Using a Journal Entry is never a preferred method to make the correction, instead the Payroll Liability Adjustment option should be used to make the correction. If the check or bill payment check is voided, the bank reconciliation with be affected. The second method should be used if the check or bill payment check was used and that check has been cleared in a bank reconciliation. If not, void the existing check or bill that is paying the payroll liabilities and recreate the check correctly by selecting Employees > Payroll Taxes & Liabilities, then Pay Scheduled Liabilities.

First, if a check or bill payment was used to pay a payroll liability, determine if the check or bill payment check has been cleared in a bank reconciliation. Payroll tax liability payments can be corrected via two methods. The entries made outside of the Pay Scheduled Liabilities function in the Payroll Center are displayed.Ĭorrecting Payroll Liability Payment Errors

QUICKBOOKS DESKTOP PAYROLL SALARIED UNPAID TIME MANUAL

In the Client Date Review, the Find Incorrectly Paid Payroll Liabilities tool, generates a report of all the manual check transactions coded to a Payroll Tax vendor. The message directs the user to use the Pay Payroll Liabilities feature to create a payroll liability check.įind Incorrectly Paid Payroll Liabilities When the user clicks the Pay Payroll Liabilities button in the warning message, the user is directed to the Select Date Range for Liabilities dialog. This message warns but does not prevent users about using the wrong type of payment (i.e., Write Checks or Enter/Pay Bills) when attempting to make payroll liability payments. If the company has written checks or used the Enter/Pay Bills entered bills functionality to pay for these liabilities, and the QuickBooks-created Payroll Liabilities account was assigned, the following warning message appears: This includes paying accrued payroll taxes to the respective taxing authorities. QuickBooks payroll works best when all payroll activity is performed from within the payroll menus. Once payroll is installed, a Payroll Setup Tool walks the client through the process.

QUICKBOOKS DESKTOP PAYROLL SALARIED UNPAID TIME HOW TO

However, some users will click past these warnings and still process the payroll incorrectly perhaps for a lack of understanding as to how to do otherwise.Ī client must first subscribe to one of Intuit’s payroll offerings for payroll to be established. If users heed the warnings, errors are often avoided. QuickBooks does warn users in several instances when the recommended procedures are not followed. Payroll Tax Expense is higher than expected.Payroll Liabilities are higher than expected.The most common error in this area is that the Pay Payroll Liabilities feature was not used rather payroll tax payments were entered using Write Checks or Enter/Pay Bill functions.Ĭommon Error: Clients Write Checks (or use check register) to pay payroll tax liabilities. Most often the errors are the result of incorrect or inconsistent procedures. Payroll tax returns have been prepared and filed showing no balance due (and no notices to the contrary have been received) Payroll, (and inventory discussed elsewhere), are two areas where QuickBooks ® is less forgiving and clients are more likely to make mistakes.

0 kommentar(er)

0 kommentar(er)